Background

I have been watching SPOT for a while now and it surprises me that the market does not price SPOT at 3% above the target. Z tranche is equity, so A tranche should be a bond that the market discounts now relative to its value at maturity. The tranche contract alone does not make A tranche a bond, we also need the Buttonwood Zero contracts so that the A tranche is paired with USD and discounted by the market.

What if there was another way to make A tranche a bond, without needing to pair A tranche with USD? If Z tranche grows, we can redirect that growth to the A tranche and cap it so the A tranche earns anywhere from 0% - 20%. If Z tranche shrinks, A tranche is protected like a senior tranche.

These new A’ tranches behave more like a company’s bonds, where earnings is paid out first to the bonds and then to the equities. We can do this with the contracts @G-Yes95, @sunbreather, and I developed for HourGlass during the hackathon.

The App

Here is an outline of an app that integrates A’ tranches into SPOT.

SPOT is backed by AMPL A tranches with an A/Z ratio of 20/80. Z tranches are levered 1.25x because Z tranches grow 25% if AMPL grows 20%. A tranches are levered 0x until all Z tranche equity disappears at which point A tranches are levered 1x.

Tranche growth is always with respect to the AMPL marketcap at the time the bond was created. 100 AMPL deposited at bond creation is the same value in tranches as if 50 AMPL is deposited after the AMPL marketcap shrinks by 50%.

When a user deposits AMPL into the app, the AMPL is routed into the Spot contract and the app gives all SPOT to the user but retains all Z tranches. The app uses Z tranches for accounting. If 80 Z tranches are minted, 20 OPTION tokens will be minted. OPTION steals all Z tranche growth if AMPL grows anywhere from 0% to 4% at maturity, OPTION is levered 5x and is more volatile than Z tranche. If AMPL grows more than 4% at maturity, OPTION stops stealing Z tranche growth, OPTION is levered 0x and Z is levered 1.25x. If AMPL grows 0% or shrinks at maturity, OPTION will expire worthless.

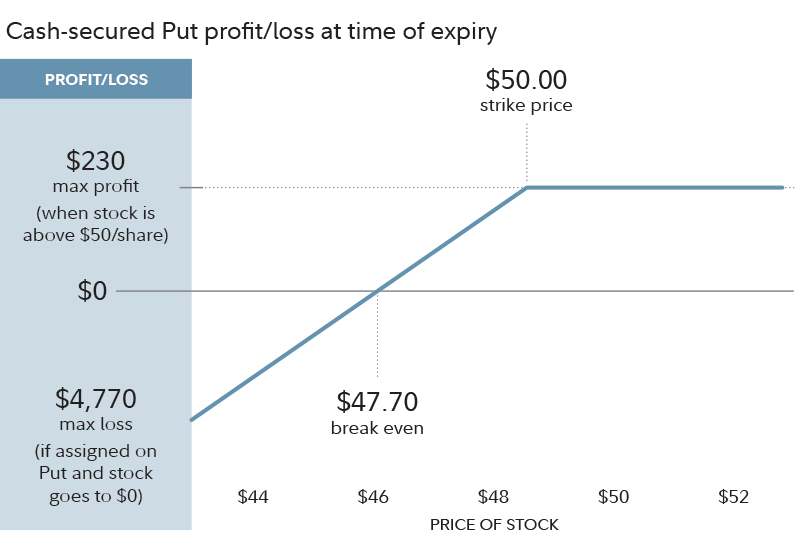

The profit/loss of buying OPTION looks a little like the profit/loss of selling puts.

Source: Cash covered puts - Fidelity

Summary

I’m open to comments. Is holding A’ tranches more attractive than holding A tranches? Do these new tranches make it easier to leverage exposure to rebases, since these tranches can be sold at a higher price? Will the market price SPOT at 3% above the target if we replace all A tranches backing SPOT with these new A’ tranches?